Welcome to the Revenue Leadership Hub

Canopy's Augmented Revenue Intelligence Platform increases visibility, accuracy and predictability for every individual in the revenue team.

Features

One Platform. Every Answer.

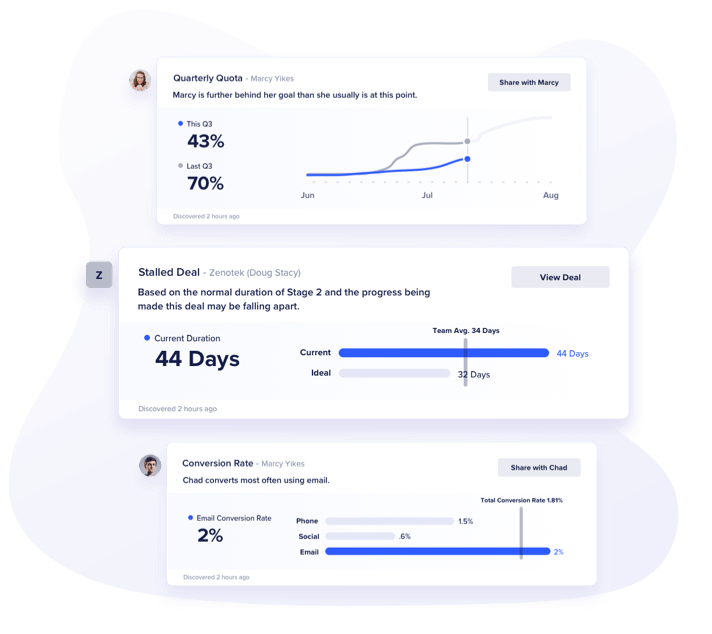

Signals

Real-time awareness through active data monitoring, notifications, and custom goal tracking.

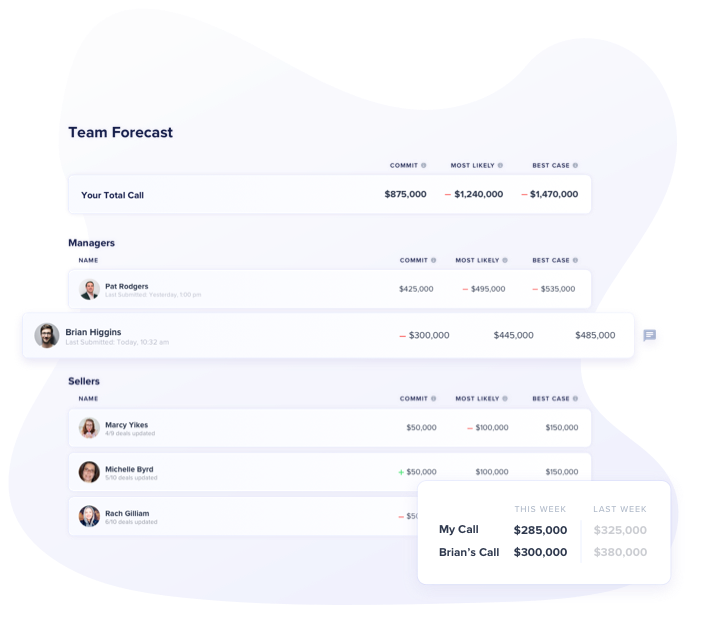

Forecast

Streamline your forecasting process while monitoring and measuring variance to drive constant improvement.

Coach

Drive productivity and results through individual assessments, improvement tracking, and notes.

Analyze

Answer key questions around trends, risks, and past performance through snapshot reporting for any period and any subset of data.

Solutions

How can Canopy help you?

Revenue Leadership

Gain the visibility needed to confidently call your business while keeping your managers focused on what matters most.

Sales & Revenue Ops

Reduce the manual analysis and focus on the bigger picture. Provide your teams with the answers they need in real-time.

Enablement & Productivity

Identify the key opportunities for improvement and measure the ROI of every initiative you roll out.

Frontline Sales Manager

Stop playing from behind and proactively drive every sellers productivity and revenue attainment.